Key Highlights

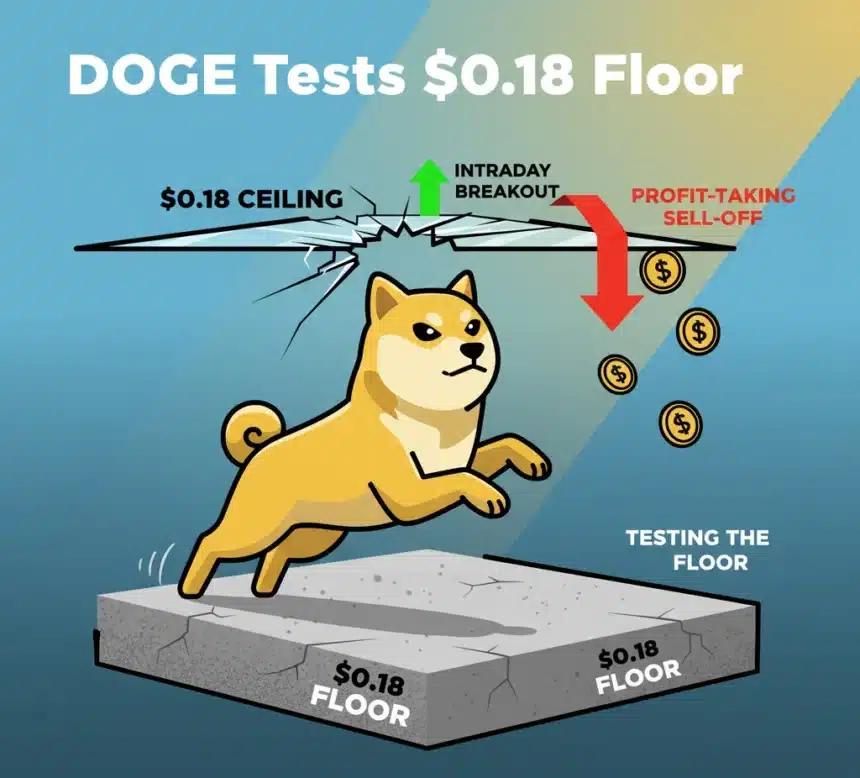

- Dogecoin’s price suddenly jumped past a high point (a “ceiling”) it had been struggling with, which is called a breakout.

- This jump immediately caused many traders to sell their coins quickly to lock in their gains (this is “profit-taking”).

- The mass selling pushed the price back down to the $0.18 level.

- The $0.18 price is now being tested as a “floor,” and traders are watching to see if the price can stay above it to show stability.

Dogecoin: Why a Small Price Jump Led to a Quick Dip at the $0.18 Mark

Dogecoin (DOGE), the fun-loving digital currency that started as an internet joke, recently saw its price take a quick trip up only to immediately settle back down around the $0.18 mark. For anyone watching the market, this kind of movement can seem confusing. Why did the price jump, and why did it fall back so fast?

The answer lies in two simple market ideas: a “breakout” and “profit-taking.” We can think of it like a crowded bus stop.

The Price Jump: Breaking the Ceiling

First, let’s talk about the jump. The market saw a big push that moved the price past a high point it had struggled to beat recently. Imagine $0.18 had been a stubborn ceiling for a while. Every time the price went up to that level, it bounced back down.

When the price finally manages to punch through that ceiling, it’s called breaking the ceiling.

This success acts like a starting gun in a race. It sends a powerful signal to everyone trading Dogecoin that something is changing. They see the price move higher than it has in a while, and they think, “This is it! The price is going to keep climbing.” This excitement makes more people rush in to buy, which pushes the price up even more. It’s a rush of excitement and buying power that creates a sudden, noticeable spike.

The Quick Fall: Taking Money Off the Table

Now for the second part: the price retreating. This is where taking money off the table comes in.

Picture this: many traders had bought Dogecoin when it was much cheaper say, at $0.16 or $0.17. When they saw the price finally break out and shoot up, maybe hitting $0.19 or even slightly higher, they thought, “Perfect! I’ve made a quick profit.”

Taking money off the table is simply a trader choosing to sell their coins after the price has risen. They are ‘cashing in’ on the gains they just made. When lots of traders do this at the same time which often happens right after a quick rise it creates a huge wave of selling.

This mass selling quickly becomes stronger than the buying that caused the initial jump. With so many coins suddenly being offered for sale, the price cannot stay high. It gets pushed back down.

Why $0.18 is Important: The New Floor

When the price falls back, it doesn’t just crash to the bottom. It usually settles on a key number that the market views as a “floor” (a stable resting place). In this case, that key number is $0.18.

- The $0.18 level was the ceiling the price had to break through.

- Now that it briefly broke through it, the market wants to see if that old ceiling can become the new floor.

When the price slides back to $0.18, the market is testing the floor. Traders are watching to see if buyers step in again at that price to keep it from falling lower. If the price holds at $0.18, it suggests this is a strong, stable level where people feel comfortable buying. If it falls below, it means the sellers are still in charge, and the coin might drop to an even lower, safer price point.

What Happens Next? The Tug-of-War

This up-and-down movement is a very normal part of the crypto world. It shows that Dogecoin is currently in a state of balancing out:

- There is enough excitement to push the price higher.

- But there is also a lot of selling from people taking their profits that brings the price back down quickly.

For now, the story of Dogecoin is a tug-of-war around $0.18. It is a key level that will likely decide what happens next. If the price can stay steady above $0.18, it builds a stronger foundation for a bigger move up later. If it slips and stays below, it suggests the sellers still have the advantage for the time being.

It’s a waiting game now, as the market decides if the brief moment of excitement can turn into a solid, lasting rally.