Key Takeaways

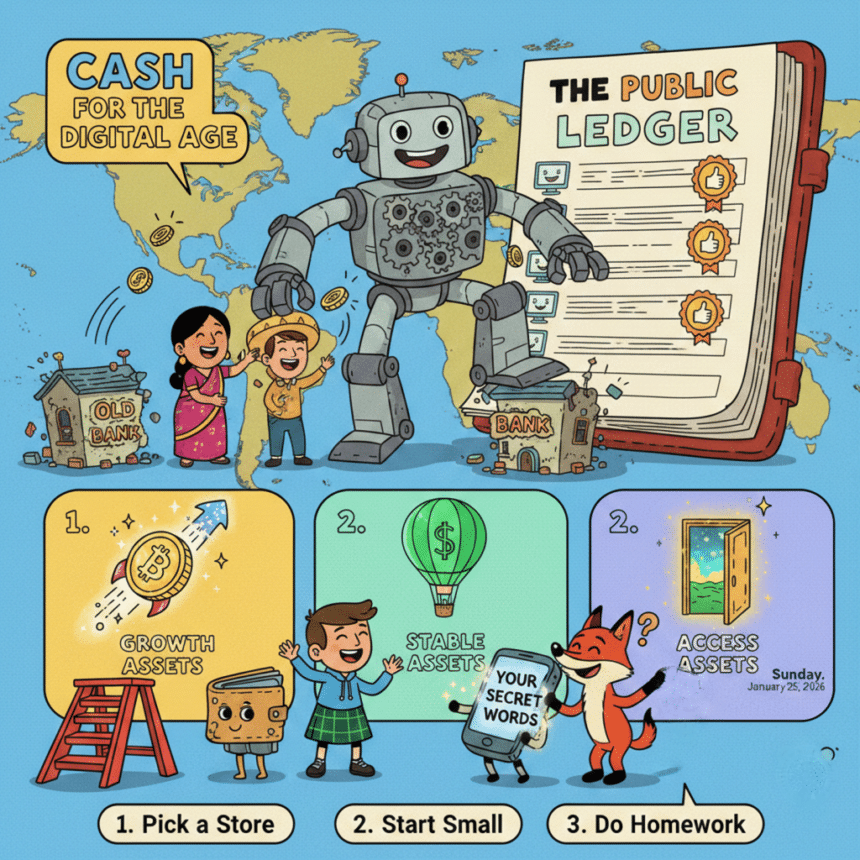

- Direct Payments: You can send money to anyone in the world directly, like handing someone a physical dollar bill, but online.

- No Bosses: There is no central bank or company in charge; the system is run by a giant network of computers.

- Be Your Own Guard: Since there is no bank to call for help, you are responsible for keeping your digital “keys” safe.

New Digital Money: How it Works and Why it Matters

If you have heard people talking about “online money” but felt confused, you aren’t alone. This guide breaks down the basics using simple language. We explain how this money moves without banks and how you can keep your own digital cash safe.

What is Digital Money?

Think of this as “Internet Cash.” Normally, when you pay for something with a card, a bank acts as a middleman. They check your account, approve the deal, and move the numbers.

With this new digital money, the middleman is gone. The money moves from your phone to someone else’s phone instantly. It is a way to own and move value without needing permission from a big institution.

How the “Public Ledger” Keeps Everyone Honest

You might wonder: “If there’s no bank, how do we know who has the money?”

The system uses a Public Ledger. Imagine a giant, digital notebook that everyone in the world can see.

- When you send money, it is written in the notebook.

- Thousands of computers check to make sure you actually have that money.

- Once they agree, the transaction is locked into the notebook forever.

- No one can go back and erase it or change the numbers. This makes it very hard to cheat.

The Three Main Types of Assets

In 2026, most people will use digital assets in three different ways. Here is a simple breakdown:

| Type | Like… | Why use it? |

| Growth Assets | Digital Gold | People buy it hoping the price goes up over time. |

| Stable Assets | Digital Dollars | These stay at the same price (like $1) so they are easy to spend. |

| Access Assets | Digital Tickets | You need these to use certain special apps or online clubs. |

How to Keep Your Money Safe

Because there is no bank to help you if you mess up, safety is the most important part of getting started.

Your Digital Wallet

You store your digital money in a “wallet.” This is usually an app on your phone or a small device that looks like a thumb drive. It doesn’t actually hold the “coins” it holds the Digital Keys that let you move them.

The “Golden Rule” of Keys

Every wallet has a secret password (often a list of 12 or 24 random words).

- If you share these words: Someone can take all your money instantly.

- If you lose these words: Your money is locked away forever, and no one can get it back for you.

- The Scam Test: If someone online promises to double your money if you send it to them first, it is a trick. Never send money to people you don’t know.

Simple Steps to Start

If you want to try using digital money, follow this path to stay safe:

- Pick a Big Store: Use a well-known “exchange” (an online shop for digital money) to buy your first bit of cash.

- Start Small: Only put in a small amount of money like the cost of a lunch. This lets you learn how it works without stressing.

- Learn the Language: Before you buy, read about what that specific money does. Does it help people send payments, or is it for something else?

Common Questions (FAQ)

Is this real money?

Yes. You can use it to buy things at certain stores, or you can trade it back into regular dollars and move it to your bank account.

Is it safe to use?

The technology itself is very strong and hard to hack. Most people who lose money do so because they give their password to a stranger or lose their “Digital Keys.”

Why does the price change so much?

Because it is new and people are still figuring out what it’s worth. When many people want to buy, the price goes up. When they want to sell, it goes down.